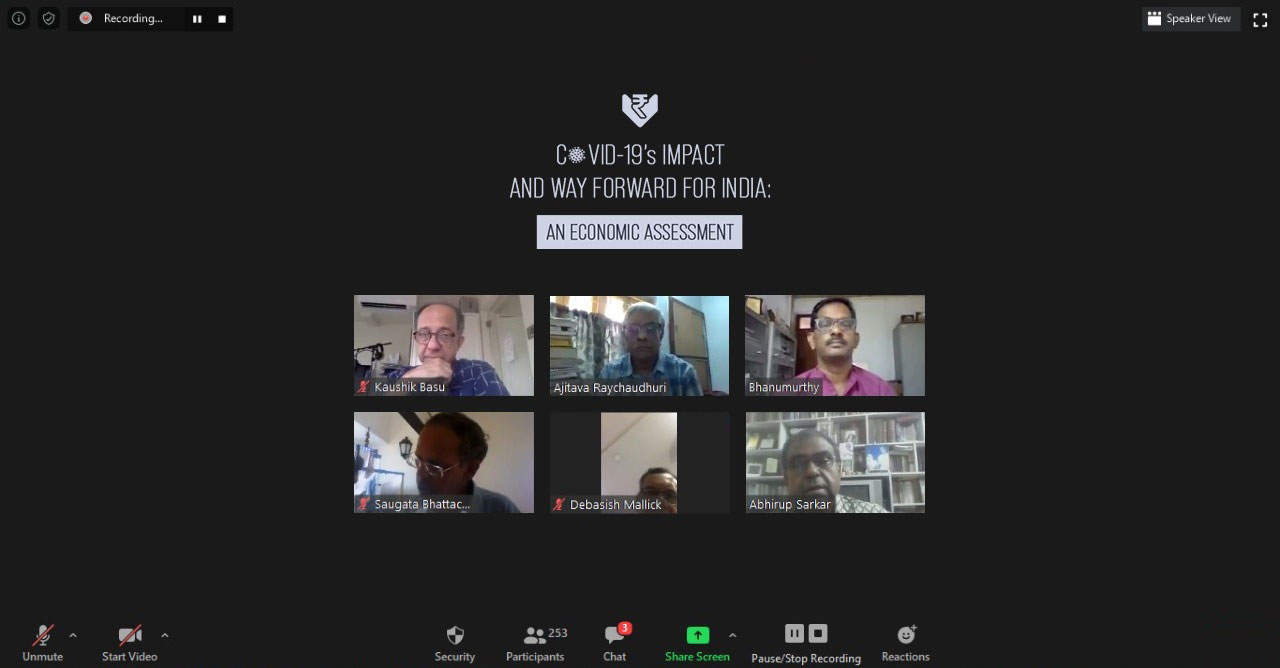

"COVID-19's Impact and Way Forward for India: An Economic Assessment (by focusing on the opportunities)" on 13th May 2020, on Zoom

The Bengal Chamber of Commerce and Industry organized an Online Session themed "COVID-19's Impact and Way Forward for India: An Economic Assessment (by focusing on the opportunities)" on 13th May 2020.

The objective of the Panel Discussion was to contemplate and discuss over the aftermath of the pandemic and learn from the subject matter experts the feasible ways to regain and improve the overall economic situation which might bring in changes in the global trade scenario.

Dr. Kaushik Basu, Professor of Economics and Carl Marks Professor of International Studies, Cornell University graced the Session along with Mr. Saugata Bhattacharya, Chief Economist, Axis Bank; Mr. Debasish Mallick, Deputy Managing Director (Retired), EXIM Bank and former MD and CEO, IDBI Mutual Fund; Prof. Abhirup Sarkar, Professor of Economics, Indian Statistical Institute and Chairman WBIDFC; Mr. N. Bhanumurthy, Professor, National Institute of Public Finance and Policy (NIPFP); Shri Sunil Mitra, Chairperson, Economic Affairs Committee, The Bengal Chamber of Commerce and Industry and Former Revenue & F inance Secretary, Government of India and Dr. Ajitava Ray Chaudhuri, Economist & Professor, Jadavpur University and Member, Economic Affairs Committee, The Bengal Chamber of Commerce and Industry.

The session with eminent speakers and subject matter experts aimed to provide possible recommendations and a blueprint to the Government on economic aspects and its way forward with significant attention on the opportunities.

The Session was commenced with the formal Welcome Address, delivered by Shri Sunil Mitra. Dr. Ajitava Ray Chaudhuri moderated the Session.

Dr. Kaushik Basu emphasized that Indian Bureaucracy should be harnessed and design a package to pull the economy out very quickly if this is packaged well. The Government should take their measures cautiously and ensure not to retrogress to the License Permit Raj. The market's natural mechanism should be allowed to function through and the Government should not take measures to control it, to stop the market from functioning and to halt the economy altogether. Dr. Basu also addressed that with a lot of economies ready to grow and boost it, several global businesses are planning to move into other countries. India should strategize to imbibe reforms in the midst of this so that we have a good future along with managing the current crisis. A lot of credit has to be directed to MSMEs because without sufficient financial aid, they might crash and dissolve without traces.

Prof. Abhirup Sarkar said that in order to take measures related to the supply side and enable smooth production, the Government has to provide easier loans at subsidized rates to the enterprises. Subsidies could be provided on public transport for those people who have to do the work on-site and people cannot come to their workplaces. Prof. Sarkar also mentioned that if support is provided to the MSMEs, West Bengal should at least get a good share of this support because West Bengal has a large number of MSME. In order to increase the efficiency of MSMEs, the expenditure on education and training needs to be enhanced.

Mr. N.R. Bhanumurthy highlighted that the Government should come out with a package and with an exit strategy from the fiscal stimulus, so that there would be some credibility on the public finances and at the same time on the Current Account Deficits as well as inflation. The Government should frame monetary policies or take suitable measures to increase savings if the fiscal stimulus needs to be financed right now and also for the medium term infrastructure investments. Revival of savings would induce more investments which will subsequently boost the potential growth of the country. Mr. Bhanumurthy also mentioned that measures should be formulated to mobilize resources and channelled towards productive purposes. Stronger public sector banks are needed more in numbers in order to facilitate the already planned large investment that we're looking for in the infrastructure sector.

Mr. Debasish Mallick emphasized that the huge amount of disruption in the Supply Chain should be factored in through easy liquidity and easy money. A restart-upfund, like equity funds and start-up funds, could be provided so that MSMEs and others can start production and the supply gets restored.

Mr. Saugata Bhattacharya mentioned that the economic recovery will depend in the immediate term on the reopening sequence. There needs to be means of recapitalizing the public sector banks. At this moment, not much should be thought about nature of borrowers and more credit should be pushed into the system.